Indicators on Paul B Insurance Medigap You Should Know

How Paul B Insurance Medigap can Save You Time, Stress, and Money.

Table of ContentsFacts About Paul B Insurance Medigap UncoveredWhat Does Paul B Insurance Medigap Mean?Some Of Paul B Insurance MedigapNot known Details About Paul B Insurance Medigap Top Guidelines Of Paul B Insurance Medigap

Eye tests, glasses, and get in touches with are a part of numerous Medicare Benefit strategies. Several Medicare Benefit prepares offer hearing protection that includes testing and medically called for hearing help.Insurance that is bought by a private for single-person protection or insurance coverage of a household. The private pays the costs, in contrast to employer-based medical insurance where the employer usually pays a share of the costs. People may look for as well as purchase insurance from any kind of strategies offered in the person's geographical area.

Individuals as well as family members may certify for financial aid to reduce the cost of insurance premiums as well as out-of-pocket costs, yet only when enlisting via Connect for Health Colorado. If you experience particular changes in your life,, you are eligible for a 60-day period of time where you can register in an individual plan, also if it is outside of the yearly open enrollment period of Nov.

What Does Paul B Insurance Medigap Mean?

15.

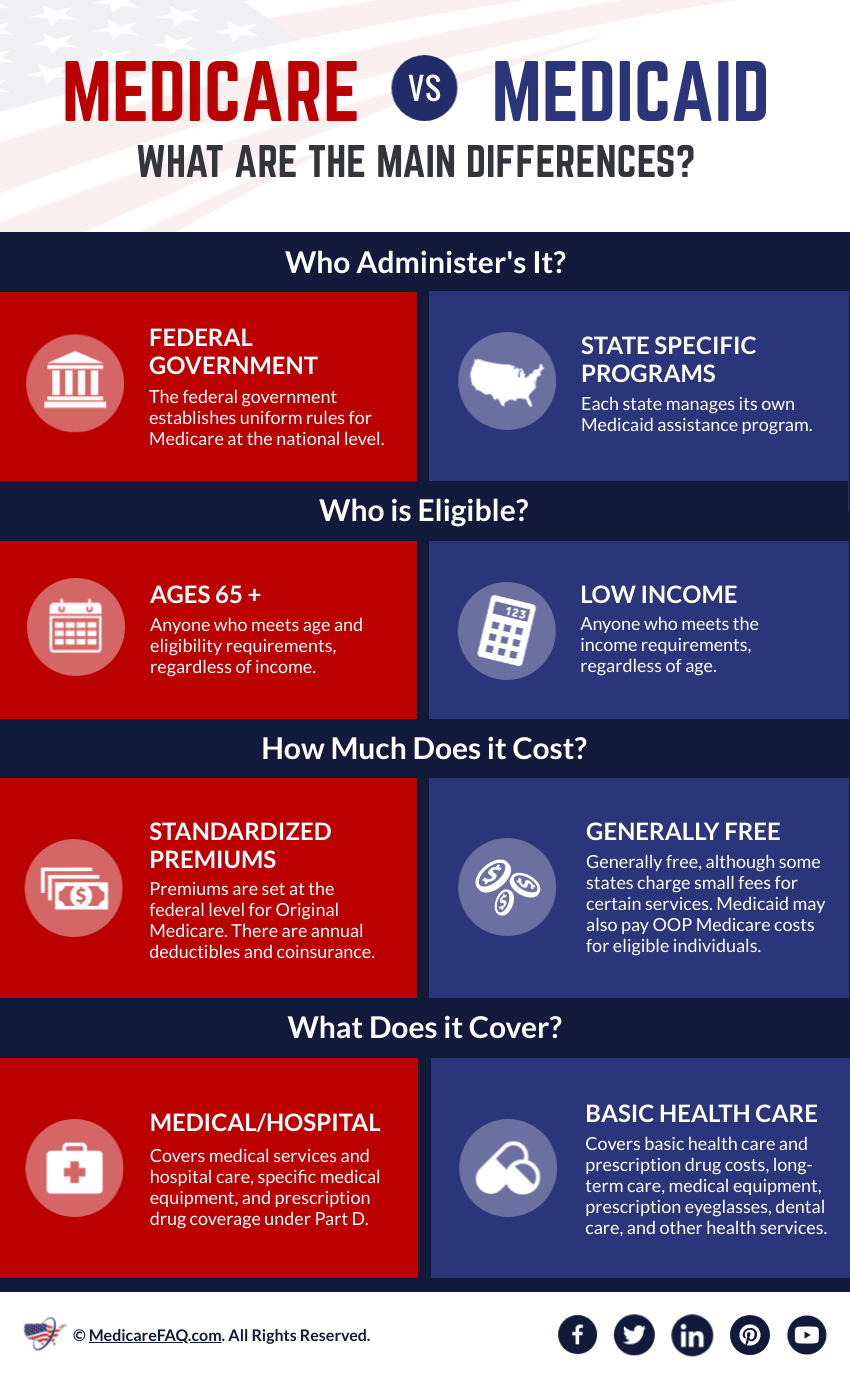

There are a lot of medical insurance options on the market, including both government-funded and also personal alternatives. Anybody age 65 or older gets approved for Medicare, which is a government program that uses cost effective health care coverage. Nevertheless, some individuals might choose to compare this coverage with private insurance policy alternatives. There are some considerable differences between Medicare and personal insurance coverage plan choices, protection, prices, and extra.

, as well as various other health rewards.

The distinctions between Medicare and also private insurance coverage are a substantial factor in deciding what kind of strategy might work best for you. When you register in Medicare, there are 2 main components that make up your insurance coverage: There are lots of options for acquiring private insurance coverage. Lots of individuals acquisition exclusive insurance with their employer, and their employer pays a section of the premiums for this insurance policy as a benefit.

All About Paul B Insurance Medigap

There are four rates of personal insurance strategies within the insurance coverage exchange markets. These tiers differ based on the percentage of services you are accountable for paying. cover 60 percent of your medical care prices. Bronze strategies have the highest possible insurance deductible of all the plans however the most affordable month-to-month premium. cover 70 percent of your healthcare expenses.

Gold plans have a much lower deductible than bronze or silver plans but with a high regular monthly premium. Platinum strategies have the least expensive insurance deductible, so your insurance coverage often pays out very quickly, however they have the highest possible month-to-month premium.

Additionally, some private insurer likewise offer Medicare in the kinds of Medicare Advantage, Component D, as well as Medigap strategies. The insurance coverage you get when you enroll in Medicare depends on what type of strategy you pick. Most individuals choose either options to cover all their medical care requires: initial Medicare with Component D as well as Medigap.

If you need added protection under your plan, you have to select one that uses all-in-one protection or add on added insurance strategies. As an example, you might have a plan that covers your medical care services but requires extra plans for dental, vision, and life insurance policy advantages. Practically all medical insurance plans, private or otherwise, have costs such a costs, deductible, copayments, and also coinsurance.

Paul B Insurance Medigap for Beginners

There are a variety of expenses associated with Medicare protection, depending on what kind of strategy you choose.: A lot of individuals are qualified for premium-free Component A protection.

The everyday coinsurance expenses for inpatient treatment array from $185. The insurance deductible is $203 for the year. Coinsurance is 20 internet percent of the Medicare-approved cost for services after the deductible has been paid.

These amounts vary based on the plan you pick. In enhancement to spending for components An and also B, Part D expenses differ relying on what sort of medicine coverage you need, which drugs you're taking, and what your premium and also deductible amounts consist of. The monthly and annual price for Medigap will certainly depend on what kind of strategy you choose.

One of the most a Medicare Advantage strategy can butt in out-of-pocket prices is $7,550 in 2021. paul b insurance medigap. Original Medicare (components An and also B) does not have an out-of-pocket max, implying that your clinical costs can rapidly add up. Here is an overview of several of the conventional insurance expenses as well as how they deal with respect to personal insurance: A premium is the regular monthly cost of your medical insurance plan.

9 Easy Facts About Paul B Insurance Medigap Described

Coinsurance is a percentage of the total approved price of a solution that you are responsible for paying after you've met your insurance deductible. Every one of these Discover More expenses rely on the sort of personal insurance strategy you select. Analyze your financial situation to identify what sort of monthly as well as yearly payments you can read pay for.